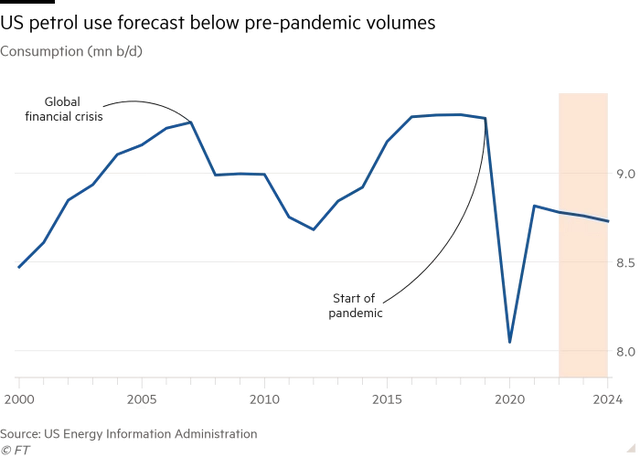

U.S. gasoline consumption is far below pre-pandemic levels and is expected to continue to decline over the next two years. However, many refiners and analysts still believe that demand for other petroleum products will continue to grow.

Gasoline consumption in the U.S. is continuing to shrink as new energy vehicles and working from home rise and fuel economy improves.

According to the U.S. Energy Information Administration (EIA), the United States consumed 8.78 million barrels of gasoline per day last year, 6% below the record before the COVID-19 epidemic, and gasoline consumption is expected to continue to decline in 2023 and 2024.

U. S. gasoline accounts for about 9% of global oil consumption and is the world's largest single market for petroleum products. The prospect of stagnant or declining demand in U.S. thus has wide-ranging implications for energy markets and carbon emissions.

"The consensus is that we're not going back to pre-COVID consumption levels," said Robert Campbell, director of energy transition research at consultancy Energy Aspects.

Gasoline consumption in the U.S. has fallen year-over-year in every month since June, in part because of record high fuel prices due to the Russia-Ukraine conflict.

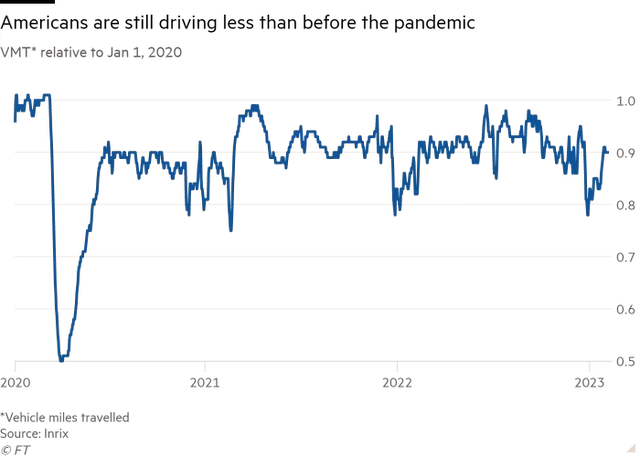

In addition, the number of trips made by car in the U.S. has also decreased slightly compared with before the epidemic. According to Inrix, which tracks travel data, motor vehicle miles traveled, a measure of road traffic, were about 90% of their early 2020 levels in January.

The decline is largely due to fewer people driving in cities, where working from home remains popular. According to a recent Gallup poll, about half of U.S. workers who could telework last year chose a hybrid work modes. Last fall, San Francisco’s motor vehicle miles were still less than 60% of pre-pandemic levels, according to Inrix data.

"Mobility has changed," said Bob Pishue, transportation analyst at Inrix. "The closer you get to a dense urban center, the less people drive."

What's more, according to the U.S. Environmental Protection Agency (EPA), the average vehicle's fuel economy improved by about a third (or six miles per gallon) from 2004 to 2021, and the associated carbon Emissions were reduced by a quarter.

"Fuel economy is improving every month, every year," said EIA oil analyst Jeff Barron.

The agency's long-term outlook to 2050 does not foresee gasoline consumption returning to pre-pandemic levels. EIA expects that improved road traffic efficiency will curb oil demand growth in OECD Americas by more than 150,000 barrels per day in 2023.

For the U.S., by far the largest oil consumer, rapid growth in electric vehicle sales would save an additional roughly 50,000 barrels per day of fuel consumption.

"The heyday of gasoline is over," said Alan Struth, an analyst at S&P Global Platts.

Some U.S. refiners also echoed the trend. Brian Partee, senior vice president of Marathon Petroleum, said a few days ago that the company's latest forecast shows that gasoline consumption in the U.S. will drop by 3% from the level before the epidemic, which is potentially very tricky.

But refiners and many analysts still see demand for other oil products continuing to grow. One area of focus is the petrochemical industry, where cheap electricity gives the US a huge advantage over the rest of the world. “Overall, it doesn’t look like total U.S. oil demand has peaked yet. We’re approaching peak demand, but we’re not there yet; it’s possible we’ll see it in 2025 or 26,” Struth said.