The Topaz solar photovoltaic power station in California, USA, has more than 9 million solar photovoltaic modules. Although the product looks quite old, ten years ago it was the largest solar photovoltaic power plant on the planet and the first fully operational 500MW installation in the United States. The 9.5-square-mile plant cost nearly $2.5 billion and was originally built by First Solar in the United States. In 2011, it was acquired by the Buffett for 2 billion US dollars. In fact, this is just the tip of the iceberg of Buffett's new energy empire.

Berkshire Hathaway owns dozens of holdings, ranging from Coca-Cola to American Express. But Buffett said the company has four main growth engines. He has been explaining this in detail in past shareholder letters.

The first engine, Berkshire's stake in Apple, made $100 billion a few years after Buffett bought the stock.

The second engine is Berkshire's 100% ownership of the BNSF railroad -- the largest railroad in the United States by freight volume. It paid Berkshire more than $40 billion in dividends.

The third engine is Berkshire's property and casualty insurance business, National Indemnity. In the same 2020 letter, Buffett called it the most important engine driving Berkshire's growth since 1967.

The last engine is Berkshire Hathaway Energy (BHE), which Buffett describes as "our last giant."

How to soberly view the backwardness of new energy in the United States

In the new energy race between solar photovoltaic and wind energy, China has surpassed its powerful opponents by several positions. The author personally believes that this lead is at least five to ten years.

As of January 2023, the installed capacity of wind power in the United States is 141.3GW, accounting for about 12% of the total installed capacity of power generation in the United States.

By the end of March this year, my country's installed solar photovoltaic capacity totaled 425.89GW, and its wind power installed capacity totaled 375.73GW. These two items totaled 801.62GW, 5.67 times that of the United States, accounting for 30.56% of my country's total installed power generation capacity.

Regarding the transformation of the energy structure in the United States, Buffett hit the nail on the head when answering questions from Chinese investors at the shareholder meeting: China is one country, but the United States is composed of 50 states. The American system of government is different.

How to understand this sentence?

At last night's shareholder meeting, Buffett said that while Berkshire Hathaway Energy's (BHE) achievements in wind and solar energy investments are unparalleled in the US utility industry, it still only scratches the surface in terms of the entire United States.

2022 BHE financial report

Buffett's successor comes from Berkshire Energy

Buffett has been investing in clean energy since the early 2000s, calling it one of Berkshire Hathaway's "four gems" in his annual shareholder letter.

In Berkshire's territory, BHE is not the largest. But the successor chosen by Buffett is the current head of BHE, which shows that he attaches great importance to energy.

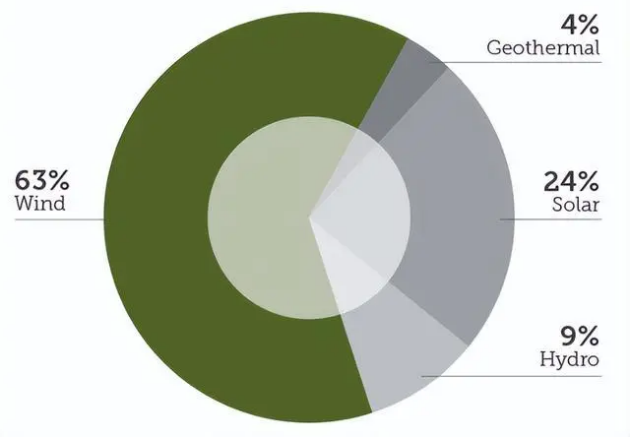

As of December 31, 2022, Berkshire Hathaway Energy had invested more than $31.6 billion in its own wind, solar and geothermal projects. 52% of the company's owned and contracted electricity generation comes from renewable and non-carbon sources.

In terms of wind power, by the end of 2022, BHE's total investment in wind power will be approximately US$14.4 billion, with an installed capacity of 7.4GW. Pacific Power plans to build 9.11GW of newly installed wind power capacity in the next 20 years.

In terms of solar photovoltaic power generation, as of the end of 2022, BHE's total investment in solar photovoltaic power generation will be US$7.3 billion. Its Topaz and Solar Star power stations are both located in California, USA, with an installed capacity of 1.136GW of solar power generation capacity. Its subsidiary NV Energy plans to have 525 MW of contracted solar resources in commercial operation by August 1, 2023, and plans to have an additional 400 MW of self-owned solar resources and 1.318GW of contracts by August 1, 2024 Solar energy resources for commercial operation.

Even so, BHE is not the largest renewable energy company in the United States. NextEra Energy is the boss. Headquartered in the United States, the company currently has a generating capacity of about 30GW, mainly from wind and solar.