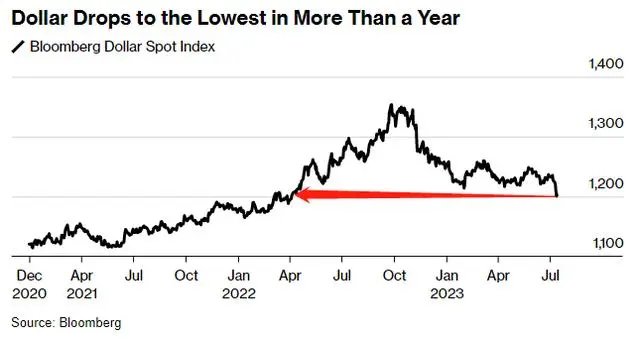

In light of the substantial cooling down of US inflation reflected in the June Consumer Price Index (CPI) and Producer Price Index (PPI), the US dollar index plummeted by 2.26% last week, marking its worst weekly performance since November 2022 and hitting a 15-month low. During the Asian early trading session on July 17 (Monday), the US dollar index continued its downward trend below 100. Concurrently, the weakening of US bond yields further diminished the attractiveness of the US dollar while bolstering other currencies like the Japanese Yen and Mexican Peso. Many strategists and institutions now opine that the strong cycle of the US dollar as a global reserve currency has come to an end, with far-reaching implications for the global economy and financial markets.

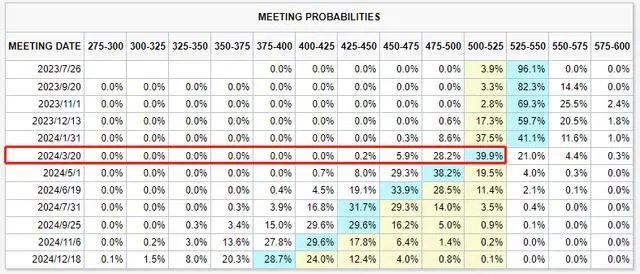

Last week's inflation data, showing a significant deceleration, has also fueled market expectations that the US Federal Reserve will soon halt its interest rate hikes. Bearish institutions have extended their outlook into the distant future, foreseeing inevitable rate cuts by the Fed, likely to occur sometime in 2024. Lee Hardman, Senior FX Analyst at Mitsubishi UFJ Financial Group, conveyed that the US dollar still has room for further downward corrections during the remaining months of this year.

According to data from the US Commodity Futures Trading Commission (CFTC), investors have been betting on a weaker US dollar for several months. In the month leading up to July 7, the CFTC's net short positions on the US dollar increased by more than double, although still below 2021 levels. Lee Hardman remarked, "Last week's substantial decline in the US dollar marked the end of the dollar bull market that began last year. Since then, the US dollar has been consistently sold off, wiping out nearly three-quarters of its gains from January to September last year. The latest International Monetary Market (IMM) positioning report from the CME Group indicates that leveraged funds have established short positions in the dollar for the past few weeks, leaving room for further speculative selling. However, this report only covers positions up to July 11, and it is likely that short positions increased further last week."

In the immediate future, the weakness of the US dollar is expected to persist until the next policy meeting of the Federal Reserve on July 26, as there are no significant US economic data releases before then. It is advised to maintain a bullish trading strategy on the Euro against the US dollar, as the European Central Bank is expected to raise interest rates by 25 basis points again this month, signaling the possibility of further rate increases later this year.

Impact on Export-Import Businesses:

The weakening US dollar is poised to have significant impacts on export-import businesses worldwide. As the dollar depreciates, it will decrease the import prices for developing countries, helping alleviate inflationary pressures. Simultaneously, the weaker dollar will bolster currencies such as the Japanese Yen, leading to a potential shift in trading strategies linked to the Yen's depreciation. Moreover, commodities priced in US dollars, such as oil and gold, are likely to rise in value, which may pose challenges for import-dependent countries.

For US-based companies, a weaker dollar could be advantageous as it increases the competitiveness of their exported products overseas while reducing the cost of repatriating foreign profits. This could benefit industries like technology, where over 50% of revenue comes from foreign markets, including major growth companies leading the market this year.

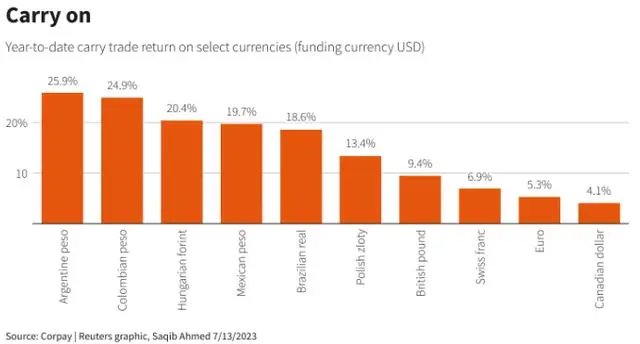

Additionally, the ongoing weakening of the US dollar is expected to benefit emerging markets by making it easier for them to service their dollar-denominated debts. Thus, emerging market currencies have already seen appreciation, and carry trade strategies, such as buying high-yield currencies and selling low-yield currencies, have gained significant profits this year.

While the prospects of a weaker US dollar are promising, investors should exercise caution, considering uncertainties in the US Federal Reserve's monetary policy and the potential impact on the global financial landscape.

Embrace the Green Revolution with OWELL Renewable Energy!

Are you ready to take advantage of the renewable energy revolution and build a sustainable future? Look no further than OWELL Renewable Energy – your partner in harnessing the power of nature to meet your energy needs.

Opportunities for Renewable Energy Projects:

With the US dollar's weakening, investing in renewable energy projects has never been more lucrative. OWELL Renewable Energy offers you a golden opportunity to contribute to a greener world while reaping substantial returns on your investments. As the dollar weakens, the import prices of renewable energy equipment will become more affordable, enhancing your project's cost-effectiveness.

Introducing Our Flagship Products:

5kW Vertical Wind Turbine: Harness the wind's potential with our cutting-edge 5kW vertical wind turbine. Designed for maximum efficiency and reliability, this turbine can power homes, businesses, and communities while reducing your carbon footprint.

10kW Vertical Wind Turbine: Take your renewable energy initiatives to new heights with our 10kW vertical wind turbine. Ideal for larger projects, this turbine guarantees optimal performance in diverse environmental conditions.

Why Choose OWELL Renewable Energy?

Proven Track Record: With a successful track record of developing and implementing renewable energy solutions worldwide, we guarantee the highest standards of quality and reliability.

Sustainability Commitment: At OWELL, sustainability is at the core of our values. We strive to create a greener future for generations to come.

Comprehensive Support: From project planning to installation and maintenance, our team of experts will be with you every step of the way, ensuring a seamless experience.

Don't Miss Out!

Seize this moment to invest in renewable energy and reap the benefits of a weaker US dollar. Contact us today to learn more about our innovative wind turbine solutions and how we can help you embark on a journey towards a sustainable and profitable future.

About OWELL Renewable Energy:

OWELL Renewable Energy is a leading global provider of innovative renewable energy solutions. We are committed to driving the transition to a sustainable future by harnessing the power of nature to meet the world's energy needs. With our cutting-edge wind turbine technology and comprehensive support, we empower individuals, businesses, and communities to make a positive impact on the environment and their bottom line.

For media inquiries, please contact:

Mr. Stephan G

Director Sales Manager

OWELL Industries - Power Generation Sector

Phone: +86-185-6150-6730 Email: stephan@owellindustries.com